In this presentation, we will discuss the retirement savings contribution credit. For more information about this topic, see the discussion below, which will have links to relevant information within it, including a link to publication 590A where much of this information can be found. In this presentation, we will discuss contribution credits. We're going to go over what is new and provide an introduction. This information can be found in publication 590A. We're going to start off with what is new. It's often good to start off with what is new because even if we're not familiar with the topic, we may have some idea of it, and we want to make sure that whatever concepts we have in our head, we unlearn any of the changes that are there because that could be the most difficult thing to do. So we'll start off with the new items and then we'll go into the introduction of what it is as of now, as of this point in time. So start now, what's new? The modified AGI or adjusted gross income limit for retirement savings contribution credits has increased. So this is going to be typically over the years; obviously, the AGI limits are going to be a kind of income-type of limits. Modified AGI is going to be some modification to them, or typically starting with if we consider our form 1040 in our mock 1040, then the AGI is on line 7. And remember that anytime we see this modified AGI, we're basically taking the amount on line 7 and modifying it for something specific to the item that we're talking about here. Oftentimes, it will be in situations that are a bit more unusual that we need some type of modification and therefore considering mainly line 7. Line...

Award-winning PDF software

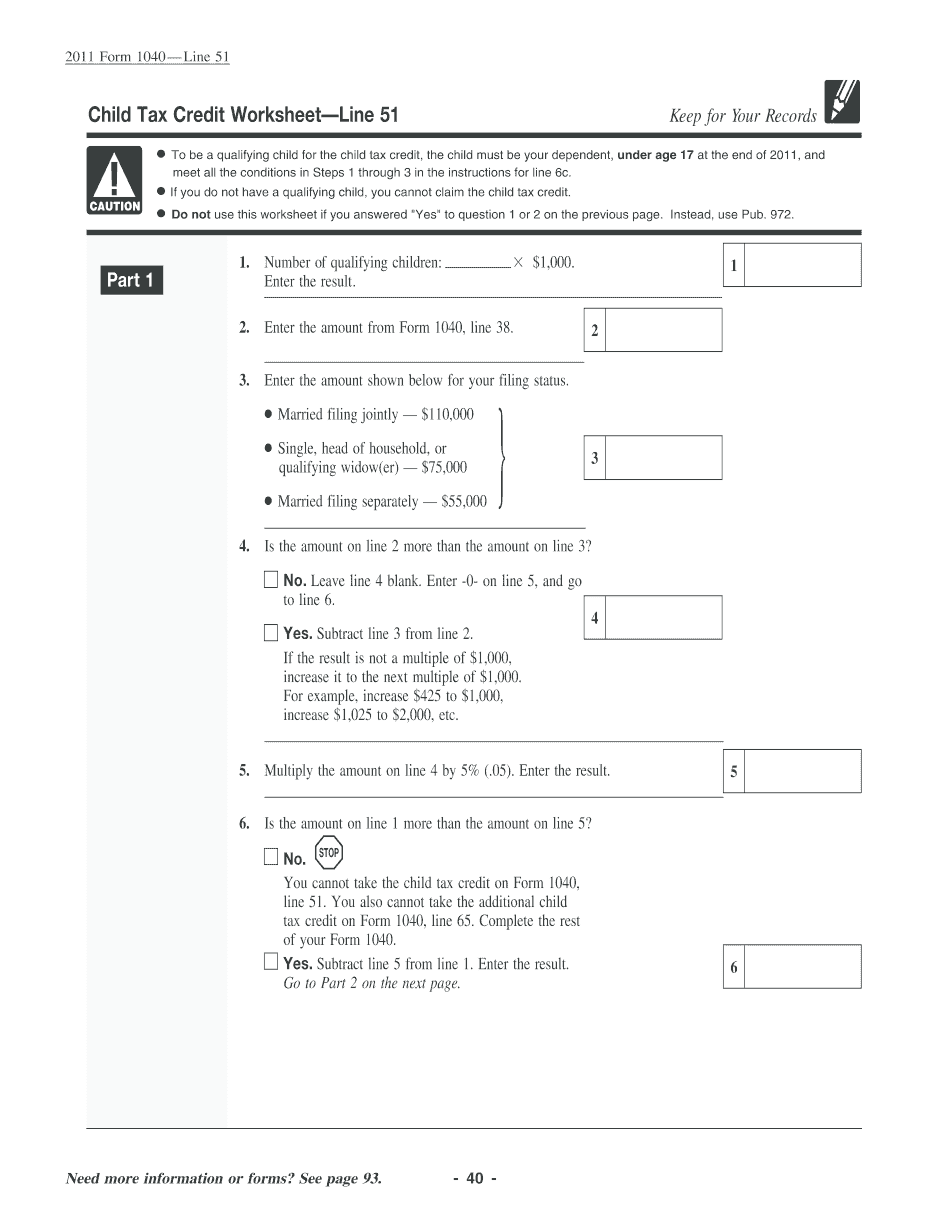

instruction 1040 Line 51 Form: What You Should Know

The other New Jersey sales tax and the 2.9% New Jersey state cigarette excise tax (Form NJ-15). Enter on Form 1040, line 42, line 36, line 56 and/or line 58 as described on the Forms and tables on IRS.gov. The 10.90% New Jersey state sales tax with Schedule C, line 2 (Form NJ-13). If you already filed Schedule C and the other New Jersey state tax, enter on line 3 of Form 1040 as described on the forms and tables on IRS.gov. The 2.9% New Jersey state tax on all property. Add the amount on line 23 to the amount on Line 26, Form NJ-3022. The 3.90% New Jersey state tax on all property, not including real estate. Add the amount on line 12 to the amount on line 27, Form NJ-3022. 4. Any federal taxes, including Medicare or FICA taxes. The IRS will also determine what your federal tax deduction would be for this year and send you a Form 1040 with your federal tax return if you file one. If your federal tax is under the limit, you will not be able to claim the refund. You'll owe state tax on that amount. The amounts shown on IRS.gov are the tax you pay for the current tax year. There are no refunds. For information on Form 8885, see IRS.gov. 5. Other federal income tax and SALT taxes, the 6.35% surcharge on federal income tax and the 9.10% credit for the first 5,000 of income if filing as single (Form 8888). Also, the 2.35% surcharge on federal income tax and 9.35% credit for the first 9,000 of income if filing as married filing jointly. 6. The other New Jersey state income tax and the 2.70% surcharge (Form NJ-15C). Enter on Form 1040, line 36, line 56 and/or line 58 as described on the forms and tables on IRS.gov. — 52 — Line by Line Instructions Free File Fillable Forms — IRS Dec 8, 2024 — Line 26 is a manual entry of the refund amount you want applied to estimated taxes for the following tax year. Income Adjusted Gross Income Your deduction is not limited. Add the amounts in the far right column for lines 4 through 28.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1040 Line 51, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 1040 Line 51 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1040 Line 51 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1040 Line 51 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form instruction 1040 Line 51