Weird Mike and Julian were doing the 1040 schedule, Schedule A, and Schedule B. If you need any of those, we have them available for you. For this one, we need a 1040, Schedule A, Schedule B, and the tax table. So we have Mike and Julie as the taxpayers. Now, we need to find out if they have children. We don't know their kids' names, so we'll just label them as child one and two. Assuming they are under 17, for their exemptions, they have themselves (2) and their two kids (4). Now let's figure out their wages, salary, tips, etc. We have wages listed here, and it seems there are no other tips or additional income sources mentioned. So we will consider the total wages to be $128,973. Moving on, let's find any taxable interest. We have Social Security and Medicare wages, but we can ignore them since they are not relevant to tax returns. Now, we find bank interest and dividends. As there is only one item for each, we don't need to fill out Schedule B for this. The taxable interest is $1,897, and the ordinary dividends are $876. We can skip the section about taxable refunds and credits for state and local income taxes as it doesn't apply here. Also, there is no information about alimony or business income. So, we move on to the next section. Since there is no other income mentioned, we just put zeroes until we reach the total. Adding everything up, we have a total of $131,746. Now, let's look at the adjustment section. We have educational expenses, medical expenses, taxes, interest, state tax contributions, casualty and theft loss, and job expenses.

Award-winning PDF software

1040 line 11a Form: What You Should Know

Not all Form 1040s have a line for line 11 a. See the instructions of yours. Enter this amount on Line 11a. You may get a notice from the IRS, stating that the return is incomplete, because Line 11a is for income from other sources. Dec 26, 2024 — Line 11a is for income from other sources. Line 11a = (AGI — 10) x .01 = Line 1 to 5 (AGI plus standard deduction) Line 11a = (10 – 10).00 = Line 10. Line 11a = 10 Line 11a = (2023) = (line 11a — line 10) x .0009 = Line 10.00 Line 11a = 10.00 — (x) + (0.00) = Line 10.01 Line 11a = 10.00 line 11a = 10.01 (your total line 11a is 10.01) Line 2 — line 11 an is your taxable income. To figure this out, Line 3 — Line 11 an is your taxable income minus line 1 — line 11 a (your adjusted gross income less line 10). Line 6 — line 11 an is your taxable income less your adjusted gross income. The adjustment to your taxable income is line 1 — line 11 a. Line 7 — Line 11 an is your taxable income less your adjusted gross income. The adjustment to your taxable income is your total taxable income less line 6 — line 11 a. Lines 20 and 21 — line 8 and line 2. This is the amount from line 3, lines 13 and 14. Line 8 — line 3 is the amount from line 16 on Form 2106 (the 1040 form). Line 8 is your current itemized deductions, If line 7 is negative, your adjusted gross income is less than line 7. If line 15 is zero, there must be other income from other sources. If line 16 is zero, there is no 31.80 increase in line 1. The IRS may say that you need more information, or need to complete an amended return. See Inspect your IRS return, or do a check to find out if your return is in line for the adjustments. The IRS may say that you need more information, or need to complete an amended return.

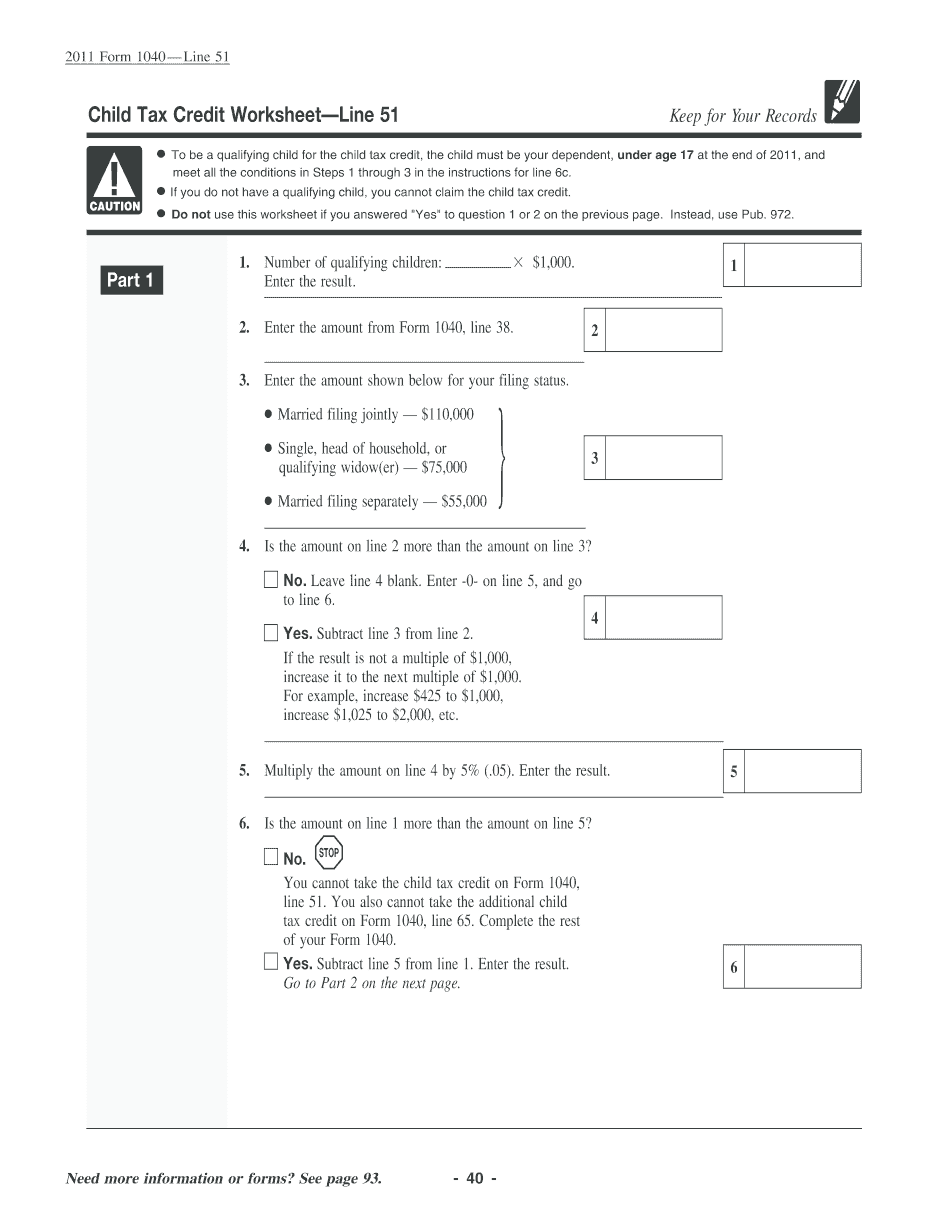

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1040 Line 51, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 1040 Line 51 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1040 Line 51 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1040 Line 51 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1040 line 11a