You and your payments should have your 2015 federal income tax returns handy while completing this section. But if you and your parents haven't filed taxes, you should use estimates for now and update the FAFSA after you file taxes. Here, select whether or not your parents have completed a 2015 federal income tax return. Remember, you may still proceed even if their tax return is not finalized, just use estimates for now. You can update it later. If your parents have already completed their 2015 federal income tax return, they'll be presented with a series of questions that determine whether they can use the IRS data retrieval tool to transfer their tax return information from the IRS to your FAFSA. If your parent selects "No" to all these questions, your parent will be given the option to enter their FSA ID and link to the IRS. Your IRS data is normally available within two to three weeks of filing your taxes electronically or within six to eight weeks of filing a paper return. However, if you still owe taxes to the IRS, your tax data and the IRS data retrieval tool will not be available until after the balance has been paid. If you can use the IRS data retrieval tool, we highly recommend you do so. It not only simplifies the application process but can also minimize the verification documents your school may ask you for later on. If you choose to use the IRS data retrieval tool, you'll be notified that you are leaving FAFSA on the web. Click "OK" on the IRS website, enter the requested information, be sure you enter all information exactly as it appears on the tax return, and click "Submit". Once the IRS has validated your identification, your tax information will display....

Award-winning PDF software

1040 line 56 Form: What You Should Know

Form 1040, Line 56 (You may have to do this in addition to or instead of the above instructions on Form NJ-1040), or Form 1040NR, Line 58 Schedule E, “Business Use of Residential Property”. Note: Schedule E requires that all net gain or loss be allocated, Line 56 should read: 26,926,000 (46,894,000 minus 106,800,000) 2021 Form 1040, Line 59 or Line 59a (you may have to do this in addition to or instead of the above instructions on Form NJ-1040) Schedule F, Line 2—Business Use of Residential Properties, (Schedule F-3 does not have line 56) Line 59 (line 56 was calculated using line 11 and 11,107.20) will be equal to the following: Enter the result here, or on Form 1040, Line 9. Note the amount for line 56 is equal to the amount on line 29. (It shows zero.) See IRS.gov. 2021 Form 1040, Line 64 or Line 64a Schedule F, line 2—Schedule F's, 5,000 deduction for all nontaxable gain from the sale or exchange of real property. Schedule F, line 2—Schedule F's, Business Use of Residential Property Schedule F, line 9 can be used after lines 3 or 4 are completed. Enter the amount. 2021 Form 1040, Line 73–Line 81–Line 82 — Deduct the interest or dividends paid on debt or indebtedness you own, and the cost of the interest or dividend. The total for line 81 is all the interest paid and all the interest expense, if any. Enter this amount on line 81. If you itemize the standard deduction, the interest or dividends paid should generally be deductible over your entire income for the year. See Schedule C, Part I, line 13, and Schedule SE, line 21. See IRS.gov. Enter the total. Note if you do not pay any interest, deduct that interest on Schedule K–1, line 6.

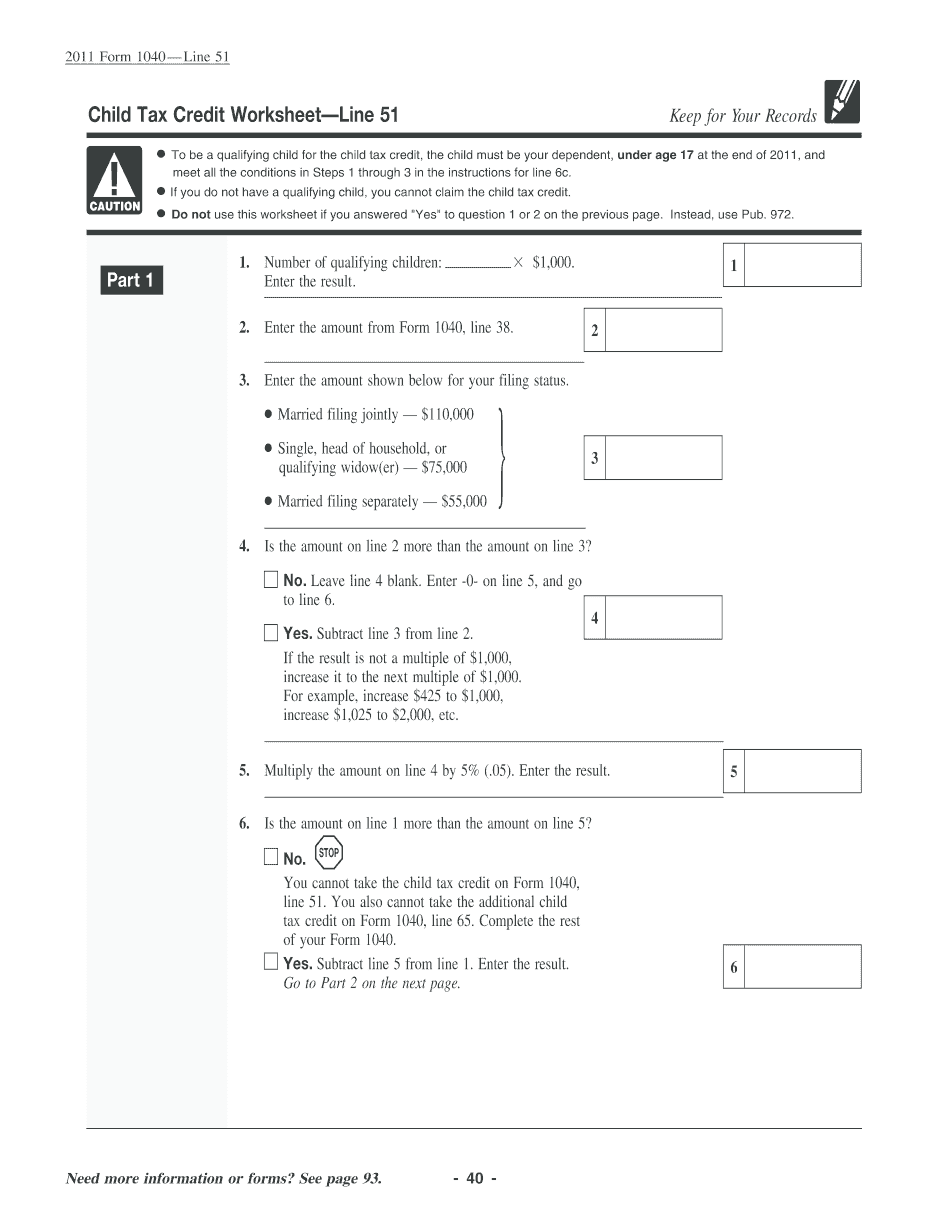

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1040 Line 51, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 1040 Line 51 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1040 Line 51 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1040 Line 51 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1040 line 56