Award-winning PDF software

Form Instruction 1040 Line 51 for Pompano Beach Florida: What You Should Know

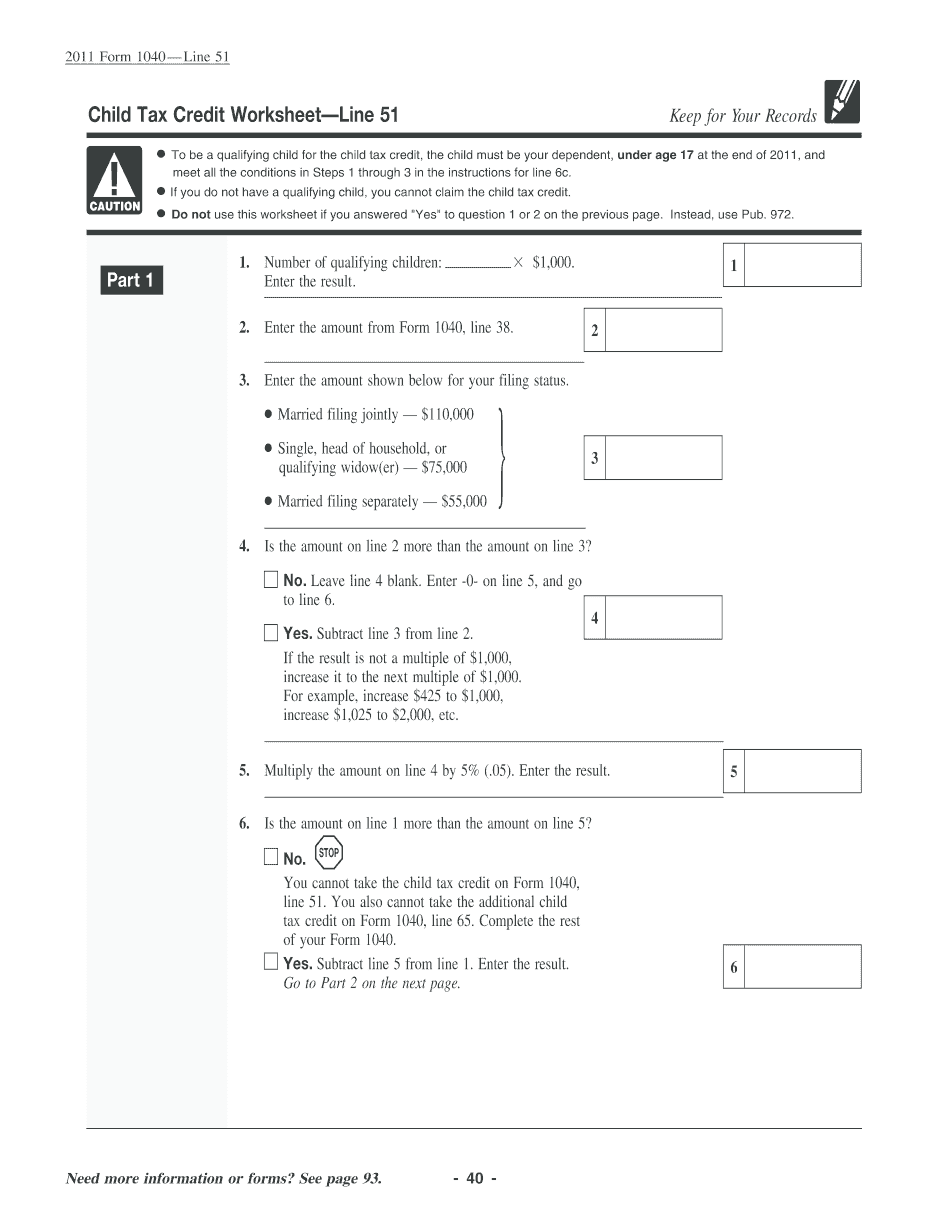

Line 1 — Amount of refund you want applied to estimated taxes for the year. Line 1 of a 1040 must be completed before January 31st (January 31st to December 31st in 2019) Line 36 — Number of dependents you want to include in estimated taxes. (You can enter a maximum of 5 dependents.) Line 44 — Deductions You've claimed for this year. You should only be claiming the following: student loan interest deductions, medical expenses/dental expenses deductions, social security/social service expenses (other than Medicare and Social Security Disability), and student loan interest deductions, professional fundraising expenses and loan interest deduction for teachers. Line 54 — Itemized deduction. Line 71 — Other adjustments for you, other taxpayers and dependent children. Line 73 — For information only, do NOT report a change of residence to a new address in a previous tax year, such as moving out of one residence and then moving into a new home or a new school. If you move, then the new address must be reported on Line 71. Line 72 — You must enter a credit against income tax. You may not claim that you're a resident alien. See IRM 5.19.13, Credit Against Income Tax, and see Pub. 15-A. The value of your return at the end of the Tax Year is your credit. Line 77 — Deductions you want to claim, only if you're filing a non-resident return for 2019. This line is a summary of deductions allowed, not a list of deductions claimed. If you want to claim that you qualify for the item you checked off on the Line 77, see IRM 5.19.4. Line 99 — Form 956, Employer's Annual Contributions Against Credit for Employees Expenses of Educational Institution, must be completed and signed by the employer. Line 10 — Amount of credit you apply to estimated taxes. Line 10 of Form 1040 must be completed before January 31st (January 31st to December 31st in 2024 and 2019). The tax year in which the taxpayer's refund was due is the first taxable year in which the deductions can be allocated. These allowable deductions may include: medical/dental expenses/student loan interest, self-employment taxes/educator expenses, charitable contributions/education/lending. Line 34 — The maximum amount you want to claim for federal income tax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Instruction 1040 Line 51 for Pompano Beach Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form Instruction 1040 Line 51 for Pompano Beach Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Instruction 1040 Line 51 for Pompano Beach Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Instruction 1040 Line 51 for Pompano Beach Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.