So far, we've learned what capital gains are, how to compute capital gains tax, and how to figure out the basis of a capital asset. However, we haven't discussed how capital gains are reported on a tax return. That's what this video is all about - I'm the tax geek, back with more of your taxes oversimplified. - To start, let's look at the reporting document you receive when you sell a capital asset at either a gain or a loss - the 1099-B. This form is the IRS version, but most of the time, this information is presented on a consolidated brokerage statement. As long as the brokerage statement shows the same information as the official form, it's an acceptable substitute. We'll examine brokerage statements in detail in another video. For now, we'll focus on the relevant parts of the 1099-B. - The left side of the form contains the usual identifying information for the payer and recipient. At the top of the form is the applicable check, which provides a code for the type of transaction. We'll discuss those codes a bit later. - Section 1 of the form shows the details of the transaction, describing the property that was sold, the dates the property was acquired and sold, how much money was received when the property was sold, and for covered securities, the cost or other basis of the asset that was sold. For non-covered securities, section 1E is often blank. - If you're unfamiliar with any of these terms, I urge you to click on the playlist above to understand the basics of capital gains. - Section 2 indicates whether the gain was short term or long term. Long-term gains are gains on the sales of assets held for at least one year. You can also figure out...

Award-winning PDF software

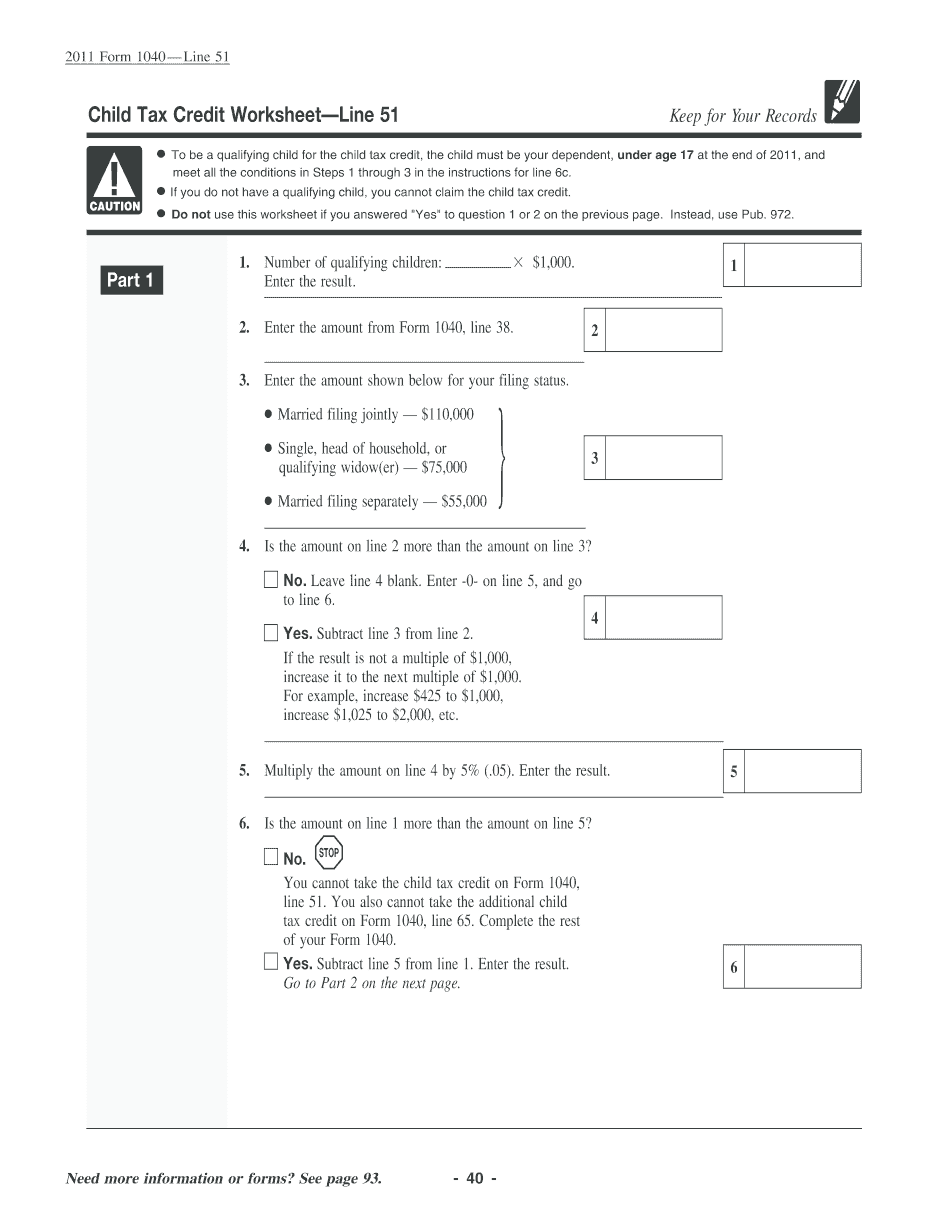

Video instructions and help with filling out and completing Form Instruction 1040 Line 51 vs. Form 1040 Schedule D