Award-winning PDF software

Printable Form Instruction 1040 Line 51 Edinburg Texas: What You Should Know

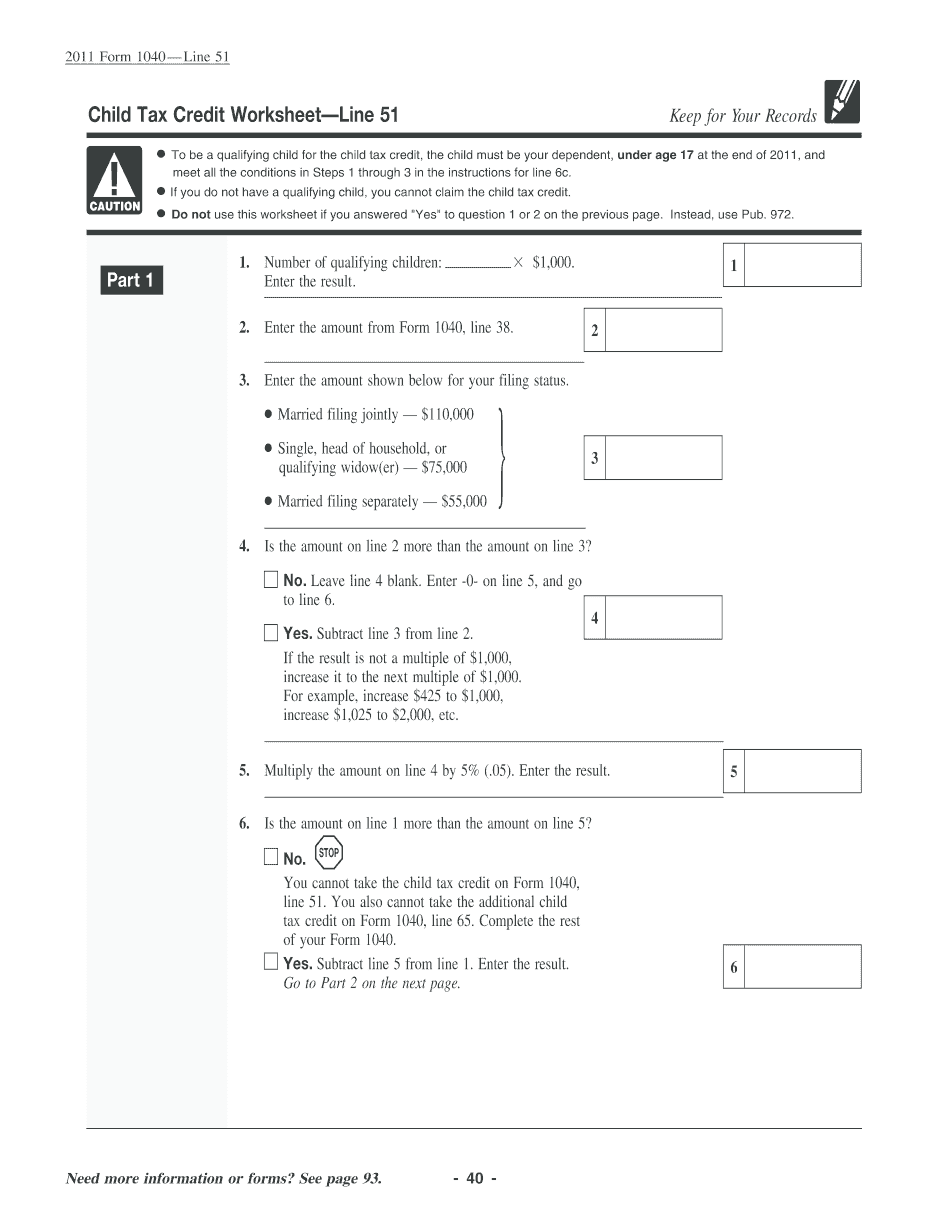

Line 1, Personal Income Tax If Schedule A is filed electronically, and you can certify that you are a U.S. person, complete Line 1. For those who file without certification, Line 9 should be filled in. Line 1, Social Security and Medicare Tax If you are not receiving an adjusted gross income (AGI) payment and would normally receive an AGI payment, complete Line 1. If your AGI is less than the maximum AGI for your filing status, complete Line 1 and enter the amount in the appropriate boxes. If you are filing Form 1040NR instead of Form 1040, complete Line 1 and enter the amount in box No. 1. If your AGI is more than the maximum for your filing status, complete Line 1 and enter the amount in box No. 1. A return under penalties of perjury may delay processing. Enter your return and payment in the correct amounts. This will be shown on Line 1. Enter the return as an itemized deduction for your tax filing return. You can use Line 21 if you want to list the deductions. 2021 Form 1040, IRA If you are age 65 or older, complete a Form 1040, IRA, and attach it to your return. 2021 Form 1040NR, Qualified Retirement Plans (RR) 2021 Form 1040NR, RESP 2021 Form 1039, Business Income 2021 Form 1040, Miscellaneous Deductions If you file Form 5010 and Line 1 is not on your return, see the Instructions for Line 11 to file Form 5010, so your return is correctly formatted. Find instructions in your tax software for completing Form 1040NR, RESP. You cannot claim the standard deduction or the tax-deductible portion of the qualified retirement plan contributions for the following years. If you paid qualified expenses for your rental property that have been placed in service after June 5, 2017, you might not be able to deduct a portion of the rental unit's income for property taxes paid to the local government. These expenses are called recaptured Section 1250 rents. In order to claim the standard deduction for property taxes, you need to complete Form 8283, Property Taxes Deduction. You must attach this return and the related Form 8283.pdf file to your return. It Is Time Fill out a paper form and send it to the IRS as soon as possible.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form Instruction 1040 Line 51 Edinburg Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form Instruction 1040 Line 51 Edinburg Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form Instruction 1040 Line 51 Edinburg Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form Instruction 1040 Line 51 Edinburg Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.